You just bought a home for $2 million in lower mainland BC, only to receive notice from BC Assessment saying your property is valued at $1.7 million. How about your neighbor’s condo that sold for $700,000 and is now assessed at $595,000? Say what? Maybe, you just bought a home in Kitimat for $1 million, and you found out that your property has increased in value to over $1.4 million in six months. That’s a pretty good return!

In early January, homeowners across British Columbia received their 2020 assessed property values, released by BC Assessment. For the most part, the province remains relatively stable. However, there are significant changes to note, including a dramatic decrease in values in the lower mainland by as much as 15 percent and increases of 41 percent in smaller areas such as Kitimat. Regardless of the situation, it can be a confusing landscape to navigate as a homeowner, seller, or buyer. Here is a look at some of the need-to-know points that demystify the real versus the perceived impact of the newly released property assessments.

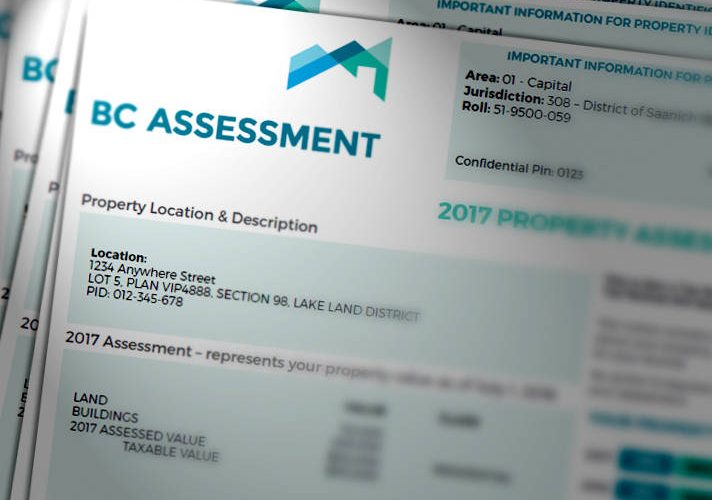

What is the BC Assessment?

BC Assessment provides a predictable base for real property taxation in British Columbia. It determines ownership, tax liability, classifies and values each property. To meet their mandate, BC Assessment completes property assessments every year. The values are completed by July 1st, and the information is based on the market trends from the previous year.

These assessments then provide the foundation for local and provincial taxing. They are used by the local and provincial taxing authorities to calculate the billions of tax revenue each year that will fund community services provided by local governments throughout the province.

“The assessments are based on what was happening in the marketplace by July 1st of last year. They reflect the conditions at that time,” says Tina Ireland, spokesperson, and assessor with BC Assessment.

How Does the Assessment Affect Property Taxes?

Although BC Assessment exists for the sole purpose of creating information for the government to determine property taxes, this description can be misleading. Governments still need a tax income to provide all the needed services in your community. By lowering taxes, some of those needs may not get met. Most homeowners will see very little change in their property taxes despite their property value decreasing. Streets still need to be cleared, schools need to exist, garbage needs to be removed. You get the picture.

What matters is what is going around you. Essentially, your property taxes have more to do with your neighborhood and community than it does with you. If your home’s value decreases more than other properties in your neighborhood, you might expect lower property tax hikes. If your property held its value more than others in your area, then you can expect larger tax hikes.

With the larger properties, a.k.a. Mansions, significantly dropping in value around Vancouver, you can expect a relatively larger increase in Condo property taxes, even though their assessments saw a 7% decrease in value. There is a fundamental shift in the tax burden to the lower-end properties.

Your taxes are dependent on your property’s changes relative to your community

“If the change isn’t great, then the effects will be negligible. If your change is greater, then you may see an impact,” says Ireland.

When predicting whether your taxes will go up this year, keep in mind City Council recently approved a 7% tax increase (better than the 8.2% they originally proposed). To expect property taxes to go down because the assessed value has gone down isn’t necessarily going to happen.

How Does it Affect The Real Estate Market?

This is the interesting part. Property Assessments are based on what happened in the months leading up to the July 1st cut-off of the previous year. In this case, July 1st, 2019.

“The start of last year saw a slump in the housing market,” says Lyn Hart of MacDonald Realty. “Because the market was slower, it affected the information used for the assessments. The market picked up in the latter half of the year.”

The assessments are not exactly a reflection of what is happening in the current market. Tina Ireland is quick to point out the assessments are just another piece of information Realtors can use to set prices and negotiate in the housing market.

“There are valleys and hills throughout time with the housing market. Sometimes it is a seller’s market, and other times it is in favor of the buyer. There is rarely a dramatic shift,” Hart adds.

There is a difference between the assessed value on home versus the market value. Fluctuation in the market is natural.

“There is not a huge bubble in the lower mainland. It is simply a pendulum that can swing in either direction for a period,” adds Hart.

How Does it Affect Prices?

Homes have an assessed value and an appraised value. The assessed value is used by tax authorities to determine how much your tax bill should be each year. The appraised value represents the fair market value of your home. The price, however, is mostly determined by what buyers are willing to pay for the property. As a seller, work closely with your Real Estate Agent in determining your price. They will have their finger on the pulse.