t the turn of the year, many of your clients may have become first-time home buyers. As a result of ongoing lobbying efforts, Budget 2019 included not only an increase to the withdrawal limit for the Home Buyers’ Plan (HBP), but also an expansion of eligibility criteria through a redefinition of what the federal government considers a “first-time homebuyer.”

As of January 2020, your clients are eligible to participate in the HBP or the First-Time Home Buyer Incentive (FTHBI) if they have lived separate and apart from their spouse or common-law partner for a period of at least 90 days as a result of a breakdown in their marriage or common-law partnership. This measure allows individuals experiencing significant life changes to continue benefitting from the stability of homeownership.

The HBP is a program that allows first-time buyers to withdraw funds from their Registered Retirement Savings Plans (RRSPs) to buy or build a qualifying home and allows them to pay back the withdrawn funds within a 15-year period. The HBP withdrawal limit was increased from $25,000 to $35,000 after March 19, 2019, for the First-time home buyers.

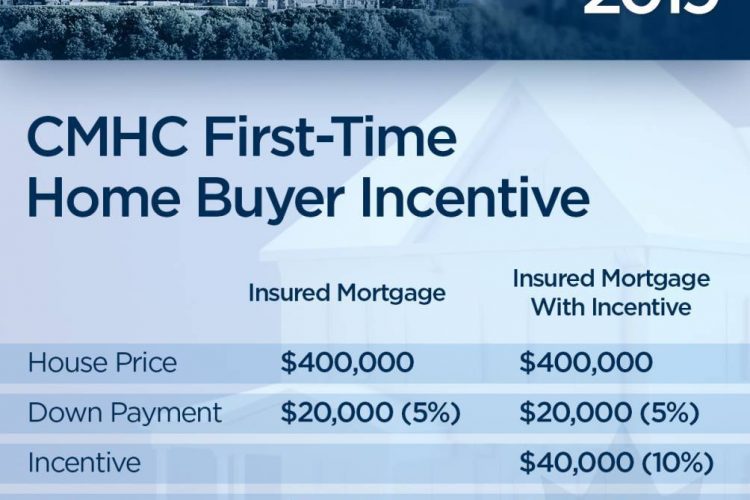

The FTHBI is a shared-equity mortgage program where the Government of Canada offers a 5 or 10% down payment on a first-time buyer’s purchase of a newly constructed home, or 5% for a resale (existing) home, for a corresponding stake in the property. To qualify, first time home buyers’ annual household income cannot exceed $120,000 and their borrowing must not exceed more than four times their income. The program was launched in September 2019 and is still accepting applications.

If you are a first-time buyer and have any questions about this program feel free to contact POURIA SADEGHI PERSONAL REAL ESTATE CORPORATION before making any real estate move or visit www.pouriasadeghi.com